Smarter Receivables. Faster Payments. Better Business.

Secure, automated receivables solutions that accelerate payments, reduce costs, enhance customer experience, and improve cash flow.

Who We Serve

Banks and Financial Institutions

Your customers demand convenient, anytime-anywhere payments. FirsTech helps banks and credit unions drive adoption, cut service calls, and boost satisfaction with seamless electronic payment options.

Utilities

Your customers need accessible and reliable payment options. FirsTech empowers utilities with seamless, user-friendly channels and a network of more than 5,000 in-person payment locations — keeping payments fast, secure, and always available.

Telecommunications

Your customers want simple, flexible ways to pay. FirsTech helps you meet their needs with text, phone, remittance, and walk-in options—ensuring seamless, reliable payments that keep them satisfied and connected.

Healthcare

You care for patients — we’ll take care of the payments. With 40+ years of experience, FirsTech streamlines electronic, text, phone, and remittance options to deliver secure, contactless payment experiences trusted by your patients and your office.

Insurance

Activating new policies for your clients has never been easier. FirsTech’s PromptPay lets policyholders pay instantly from a secure email link—ensuring faster coverage and a seamless experience every time.

Government

Municipalities and governmental agencies get flexibility and integration with full focus on customer needs. We provide 5,000 in-person payment locations, retail partnerships, and currency exchanges across the country.

With FirsTech, you’re in good company

Electronic Payment Processing

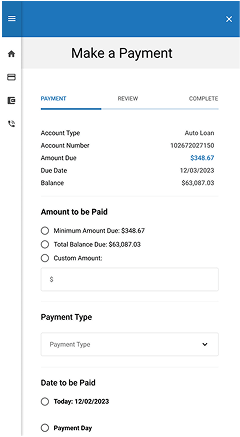

Streamline electronic payments with secure, real-time processing. Accept ACH, credit cards, and digital payments while reducing manual effort, accelerating cash flow, and enhancing the customer experience.

Lockbox Processing

Automate check processing with Firstech’s lockbox solution. Reduce manual handling, accelerate deposits, improve accuracy, and gain real-time access to payment data for better cash flow management.

Merchant Services Partners

Simplify card payments with secure, cost-effective merchant processing from FirsTech. Accept cards seamlessly, reduce processing fees, improve reconciliation, and deliver frictionless customer payment experiences.

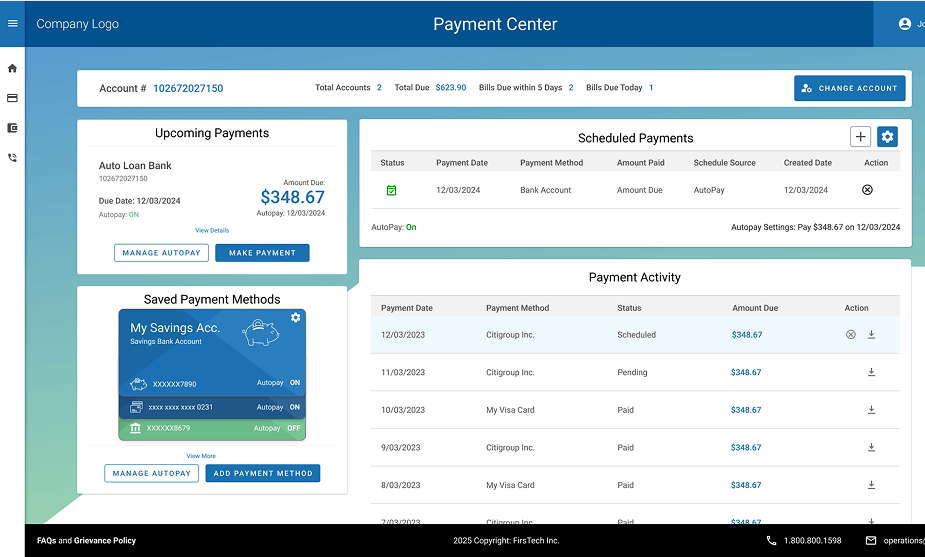

Integrated Receivables

Streamline accounts receivable by automating payment processing, cash application, and reconciliation. Accelerate cash flow, reduce manual effort, improve accuracy, and gain real-time financial insights.

Effective payment solutions make dollars — and sense

Companies using integrated receivables solutions see up to a 30% improvement in cash application speed.

Lockbox solutions reduce payment processing

time by 50%.

Automated fraud detection tools reduce payment

fraud by 70%.

Electronic payments with strong encryption are 90% less likely to be compromised.

What Our Clients Are Saying

“Through the years, the responsiveness of the FirsTech team has helped maintain a partnership, rather than just a vendor/client relationship. The ease of doing business with that team pairs very well with Afni’s philosophy and approach to working with others, and it continues to build our confidence in the relationship.”

“Partnering with FirsTech has provided us reliable payment solutions to better serve our member credit unions. Their team is dedicated to providing remarkable service and support.”

“FirsTech is reliable, responsive and helps us solve problems, as if they were part of CCI. Recently, we had a call to discuss an issue and while the CCI team had been brainstorming solutions, it was FirsTech that had the ultimate solution.”

“The employees of Firstech are friendly and always respond quickly and efficiently. I am very pleased with the excellent customer service they provide.”

“MLGW’s relationship with Firstech has been a rewarding partnership in delivering additional payment options for our valued customers.”

Decades of expertise, all in one place

Five Steps to Building a Business Case for AR Automation

The pressure on accounts receivable (AR) leaders to optimize operations, reduce costs, and drive measurable results is unrelenting. Conventional approaches to AR processing...

AR Leaders: 3 Trends Shaping 2025 and How to Stay Ahead

Accounts receivable (AR) leaders are at the heart of an organization’s financial health. Their department fuels cash flow, supports growth, and plays a pivotal role in delivering a stellar customer experience...

Navigating Trade Uncertainty: A Guide for AR Leaders

Tariffs and other trade policies have taken center stage in today's headlines, reshaping market dynamics and presenting new challenges for organizations. In this evolving landscape, accounts receivable (AR) leaders play...